BEER, CIDERS, STOUTS AND ALES

- Ruan Vd Merwe

- Mar 1, 2021

- 3 min read

Liquor Products Act (60 of 1989) regulates the production, composition and labelling of all liquor products – products for drinking purposes with an alcohol content exceeding 1 per cent.

Foodstuffs, Cosmetics and Disinfectants Act (54 of 1972) regulates beer.

Liquor Act (59 of 2003) deals mainly with the distribution of alcoholic beverages on a national level. In this act beer is described to include “ale”, “cider”, “stout” and any fermented product to be made or sold under the name of “beer”, “ale”, “cider” or “stout”.

Act 60 of 1989 therefore excludes beer, while Act 59 of 2003 describes beer to include other alcoholic products. This situation was used to make and/or sell products, mainly “ales”, which are not covered by the Liquor Products Act. This was probably not the intention of the legislator. A bill to include beer (and the extended definition products) under the Liquor Products Act is currently in process in parliament. This should eliminate uncertainties in future.

Terms & conditions

Assuming the legality of beer’s extended products in the marketplace, they must be made or sold under the name “beer”, “ale”, “cider” or “stout”. In terms of the Foodstuffs, Cosmetics and Disinfectants Act (and the subordinate legislation of this act) it is inter alia compulsory to indicate:

The name of the foodstuff on the main label in letters 4 mm high. Consequently it should state “beer”, “ale”, “cider” or “stout”.

List of ingredients, including additives.

Name and address of producer or seller.

Country of origin.

Lot identification.

Best before or Use by or Sell by date.

Storage instructions.

Allergen indication.

Health warning.

Excise: a dodgy affair

The Customs and Excise Act (91 of 1964), and the rules thereto, specifically S47(9), state that licensed manufacturers of alcoholic beverages must submit their products for tariff classification within the time periods stipulated. The tariff classification of the product will ensure that the correct excise duty is paid.

A recent survey at several liquor stores in the Western, Northern and Eastern Cape revealed that brands/products which were considered sugar fermented products in the past now sell at prices below the excise on the products. This is a blatant evasion of excise. Industry can assist the excise division by sending information of products selling at lower than excise duty to the local excise office in the area where the products are being sold. Contact Ruan van der Merwe for your SARS registrations at 012 004 0244 or ruan@mariusblom.co.za.

If the owner of a brand claims that it is a fruit base product in order to pay less excise and the price seems suspect, authorities should ensure that the product complies with labelling requirements. They may insist that the producer’s record keeping (compulsory under the Liquor Products Act) be checked. An isotope test may be required to determine whether it contains a minimum of 80% fruit.

Law enforcement

The Department of Health and the Department of Agriculture, Forestry and Fisheries, depending on the product, has inspectors and delegated inspectors to ensure that the description on the label correlates with the content of the product. They should also check that:

A sugar fermented product does not have a misleading description or brand name, featuring the word “wine” or the name of a specific fruit.

Liquor products must stipulate the A-number, a complete address, and the alcohol content on the label.

Liquor products must feature a product description on the label and display the container volume.

A sugar fermented product, just like a liquor product, must state the product class, alcohol content, name and address or code number of responsible seller, volume declaration, health warning, fill date, lot identification.

Some liquor store managers have indicated that they no longer stock the sugar fermented products because they are messy, with fermentation leaks, and because they do not want to be associated with a poor quality product. Inspectors from both departments mentioned above have to check that products do not contain ingredients that pose a health risk to consumers.

A liquor product does not have to list ingredients. The nature of liquor products is such that a complete list of ingredients is unnecessary. It is sufficient to indicate alcohol and allergen content and a health warning.

Size matters

SANS (South African National Standard) 289 regulates the quantities for liquor product packaging. This forms part of trade metrology legislation. A few years ago the wine industry submitted voluntarily to packaging requirements which subsequently became law. Sugar fermented products are not subject to the requirements of Regulation 41 of the Liquor Products Act.

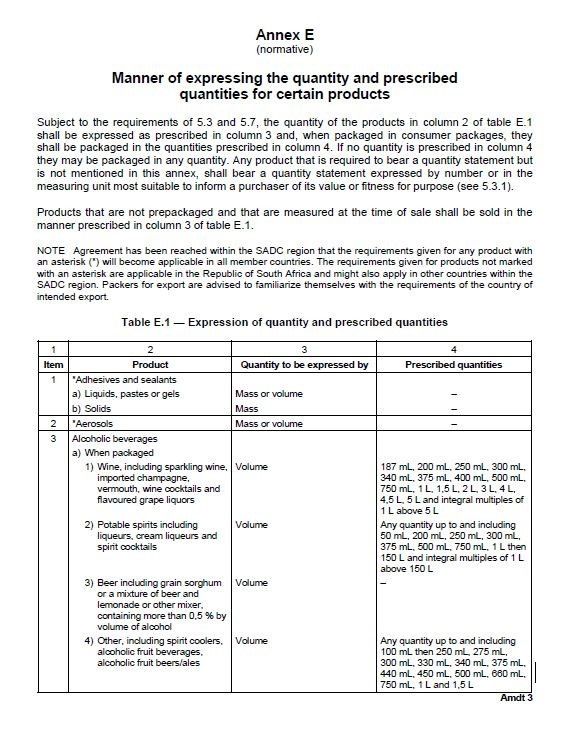

The content sizes of certain liquor products, though foreign to the wine environment, e.g. 330 ml and 660 ml, are permitted. See extract from Annex E of SANS 289 below:

If you are a micro brewer or an aspiring micro brewer, contact Marius Blom Inc for all of your liquor related legal matters, 012 004 0244, ruan@mariusblom.co.za.

Comments